Why does OPEC exist? It was created to restrain the oil production of its member countries to help keep the cost of oil on the world market high. All of the OPEC countries are countries that use only a small fraction of the oil they produce and are heavily dependent upon the price of the oil they export for their national GDP and for government revenues. If relatively modest changes of oil production and subsequent export did not change the price of oil significantly, there would be no value in OPEC at all. Now OPEC does face a number of limits on their control of the market price. One is that when the price goes up substantially, the individual members of the cartel begin to cheat or to lobby strongly to export more oil to earn more tempting dollars. Another limit is that much oil is produced in countries that are not OPEC members, so they will ramp up production of existing oil fields. They will also put more effort into finding new oil fields and developing them. Furthermore, when the price of oil goes up, people start conserving oil more by using it more efficiently and by switching to other fuels to some degree. It is also the case that rising oil prices often cause worldwide recessions and these recessions lead to less oil use. In fact, recessions usually cause oil prices to drop, though economic activity is commonly decreased by only a few percent. These actions are not good for the income of the OPEC nations. They all indicate that oil prices are sensitive to supply and demand.

Let us examine the list of the top oil producers in the world in terms of millions of barrels of oil per day with the OPEC members in red:

Russia, 10.120 million barrels/day (mbpd)

Canada, 3.289 mbpd

Mexico, 3.001 mbpd

The next 13 oil producers are rich in OPEC nations producing from 1.2 to 2.8 mbpd of oil. Uncertainties about Iran due to recent efforts to place embargoes on it and its threats to close the Straits of Hormuz have contributed to the recent rise in oil prices. But China and India are already the two biggest oil importers from Iran and they are not willing to join an oil embargo. To the extent that oil prices are not sensitive to oil supply changes, these nations continuing to take Iranian oil ought to leave the oil price less subject to change. The top 20 oil producing nations produced about 67.3 mbpd in 2011 and about 33.4 mbpd of this was by OPEC nations. If an embargo not including China and India were to take place on Iranian oil, at most 1.6 mbpd would be the drop in the world oil supply.

This amount could be made up by the other OPEC nations if they were so inclined, but if they were not, the price of oil would rise significantly. Indeed, Saudi Arabia could by itself produce much more oil and if the price of oil were not sensitive to its production, it most probably would. For sure, many of the other OPEC nations would produce more. How much more is mostly a result of how low they are willing to drive the cost of oil. If oil prices keep going up, they all make a killing even at current production levels. Somewhere there is a formula for maximizing their profits based on the price, the amount of OPEC production, and world demand for oil.

One of the problems we have had in the US is that Mexico and Venezuela, along with Nigeria, have been among the biggest sources of oil for our many large Gulf of Mexico oil refineries accounting for 40% of our total oil refining capability. The other large source is our offshore oil production in the Gulf of Mexico. The state run oil companies of Mexico and Venezuela have been producing less and less oil for several years now. Oil production in the Gulf of Mexico by the US has also fallen sharply due to restrictions on drilling in the Gulf placed by the Obama administration and the decline of existing oil field production there. To import enough oil to make up for these losses, the oil refineries have to pay world market prices and haul it in from greater distances from the Middle East.

Meanwhile, we have a relative surplus of oil piling up in Cushing, Oklahoma at the main terminal for our oil pipeline network due to the oil flowing there from the Alberta tar sands and the North Dakota Bakken oil shale formation. That oil is a boon to the oil refineries in Oklahoma, Illinois, Kansas, Wyoming, and Montana which are tied into the interior oil pipeline network. They have been able to buy oil at a price $15 to $20 a barrel less than the world market price. These refineries cannot use the supply of oil operating at full capacity. This is why Enbridge is reversing the direction of an existing pipeline that carries oil from Cushing, OK to Houston, TX and why TransCanada has decided to go ahead with building the new pipeline segment from Cushing to Houston that was part of the Keystone XL pipeline project that Obama has delayed and delayed. That segment does not cross the border, so it does not need approval by the State Department and Obama. This example of our own local oil supply exceeding the refinery capacity it can get to, is clearly an illustration that more oil production is not entirely lost in its effects on prices.

Obama is claiming that the increase in mandated for automobile gasoline mileage to 54.5 mpg will decrease oil demand and have an impact on lowering gasoline prices. This is true when, if ever, such mileage increases occur. But if reductions in oil use in the US affect prices, then so do US increases in oil production. It is contradictory to think otherwise.

There is an interesting historical event when George W. Bush was President that implies that oil prices are partially a function of future oil price expectations. On 15 July 2008, Bush ended an executive branch moratorium on oil and gas exploration and development on the outer continental shelf offshore. The price per barrel of oil very quickly fell from $149 to $136. Bush then asked Congress to end a moratorium it had put on the development and exploration of oil in the outer continental shelf.

Obama could have a similar effect. He could do the following:

- Order Energy Secretary Steven Chu to stop telling everyone that we want gasoline prices to match those in Europe at $8 to $10 a gallon. Stop telling everyone that that is his long-term goal, gradual or not. Repudiate this as a goal, ever.

- Announce that he no longer wants a cheap dollar and will therefore stop unprecedented deficit spending. The price of oil largely follows the value of the dollar.

- Just after his State of the Union address, he asked that a 50% royalty be added to all energy production on public lands, making it equal to that for offshore areas. This raised the royalty from 12.5% to 18.75% and greatly discourages drilling there and encourages the early abandonment of wells as their production falls off with age.

- Approving the Keystone XL Pipeline from Alberta will very substantially increase our oil supply and will allow that oil to be delivered inexpensively and reliably to our huge complex of Gulf Coast refineries.

- Open up more ANWR areas in Alaska so the Trans-Alaska Pipeline can be kept operational.

- Stop the glacially slow approval rate for drilling permit applications. Only 3.7 deep-water permits in the Gulf of Mexico have been approved per month since August. In the prior 3 years, 7 applications were approved on average a month. Obama has about doubled the time for environmental studies on applications.

- Stop demanding that oil companies be taxed more aggressively than any other extraction industries are and recognize that drilling for oil and gas is a very risky business. It is also a business that many thousand companies participate in, contrary to the myth that only Exxon Mobile and a few other behemoths are in the business. Most of the innovations that have swept the industry and allowed it to extract oil and gas where that was not possible years ago have been developed by these smaller companies.

- Allow the states to be the primary regulators of oil and gas production inside their boundaries. They know more about their land and the needs of their people than the central planners in Washington DC do.

- Stop wasting taxpayer money on alternative energy sources and misdirecting the efforts of so many energy businessmen, technical people, and scientists in these expensive, unreliable, and at best very long-term alternatives. The private sector will build such industries when they are capable of being economically sound.

- Understand that the oil companies want to extract oil and gas responsibly. BP is losing about $40 billion due to their mistake in the Gulf of Mexico. Companies have to have learned from that. Indeed, they have to be responsible on land as well, especially since their increased oil and gas production has been mostly on private land and private landowners have little tolerance for someone messing up their land. Private landowners are generally much better land managers than the government is.

- Make it easier to build new refineries, especially in the northern Great Plains states, such refineries would have a good supply of oil from Alberta and North Dakota and Montana. The East Coast is actually losing oil refinery capability and that is causing local prices to go up. Gasoline prices are locally sensitive to the local demand relative to the local refinery output.

- End the pointless ethanol mandates that push the cost of gasoline up substantially due to the high cost of ethanol and added blending and distribution costs. End the penalties on refiners for not blending in cellulosic ethanol in particular, since there is no commercial supply of this form of ethanol and the cost of the penalties has to be passed to the consumer. This requirement for using cellulosic ethanol is a great example of the Obama penchant for the unreal.

The United States has enough oil and gas reserves that it now knows how to extract economically that it can have a marked impact on the world market price of each, especially gas. We have a very good opportunity to switch substantial segments of our transportation industry to using natural gas, thereby cutting down on our oil demand.

But even in oil, we can raise the supply significantly sourced within the US and its offshore waters and by allowing much more Canadian oil to be piped to us. The U.S. has increased its oil production, no thanks to Obama, by 11.3% from 2008 to 2010 and further in 2011. Canada increased its oil production by 5.9% from 2008 to 2010 and continues to increase it. Most of Canada's oil is exported to the U.S. Given that global demand for oil from 2010 to 2011 increased by only 0.8%, these American and Canadian increases in oil production are significant and would have kept our prices low, had it not been for the constant uncertainty that Obama so much loves to create for our businesses. Despite some leveling toward world market prices for oil, these increases in oil in the US and Canada have allowed our gasoline prices to remain much below those in most of the world.

In addition, unleashing the oil, gas, and even coal industries will put many more Americans to work in those industries and supporting them, will reduce a major business cost for manufacturers, reduce energy costs for individuals and families, and will put more people back into jobs generally as the economy will be favorably affected. It will even produce more revenue for governments. The federal governments second largest source of tax revenue after the income tax is oil and gas royalties. That would help to reduce those horrible government deficits that are causing the value of the dollar to fall rapidly against commodities, such as oil.

3 comments:

My post on the same subject:

http://sbvor.blogspot.com/2012/03/blaming-speculators-for-oil-prices-is.html

I certainly agree that most major economic problems are caused by government interference with the private sector. The government's reaction to the problem is almost always to blame the private sector and claim that if the government only had more power the problem would have been averted. Of course, in many cases the government already had the power to take ameliorative action but did not. Usually that action should have been to do nothing, but even when it should have done something to have stopped a fraud, it more often than not, did not. Enron, Bernie Madoff, and the sub-prime mortgage bubble required by the government are among many cases that come to mind. We are clearly better off with minimal, constitutional government and our own personal and volunteer organization vigilance.

Every time there is an increase in gasoline prices the Democrats call for an investigation into speculators. After much hue and cry, the outcome is always that there is no evidence for malfeasance. But some major part of the public is fooled into thinking Congress is watching out for them.

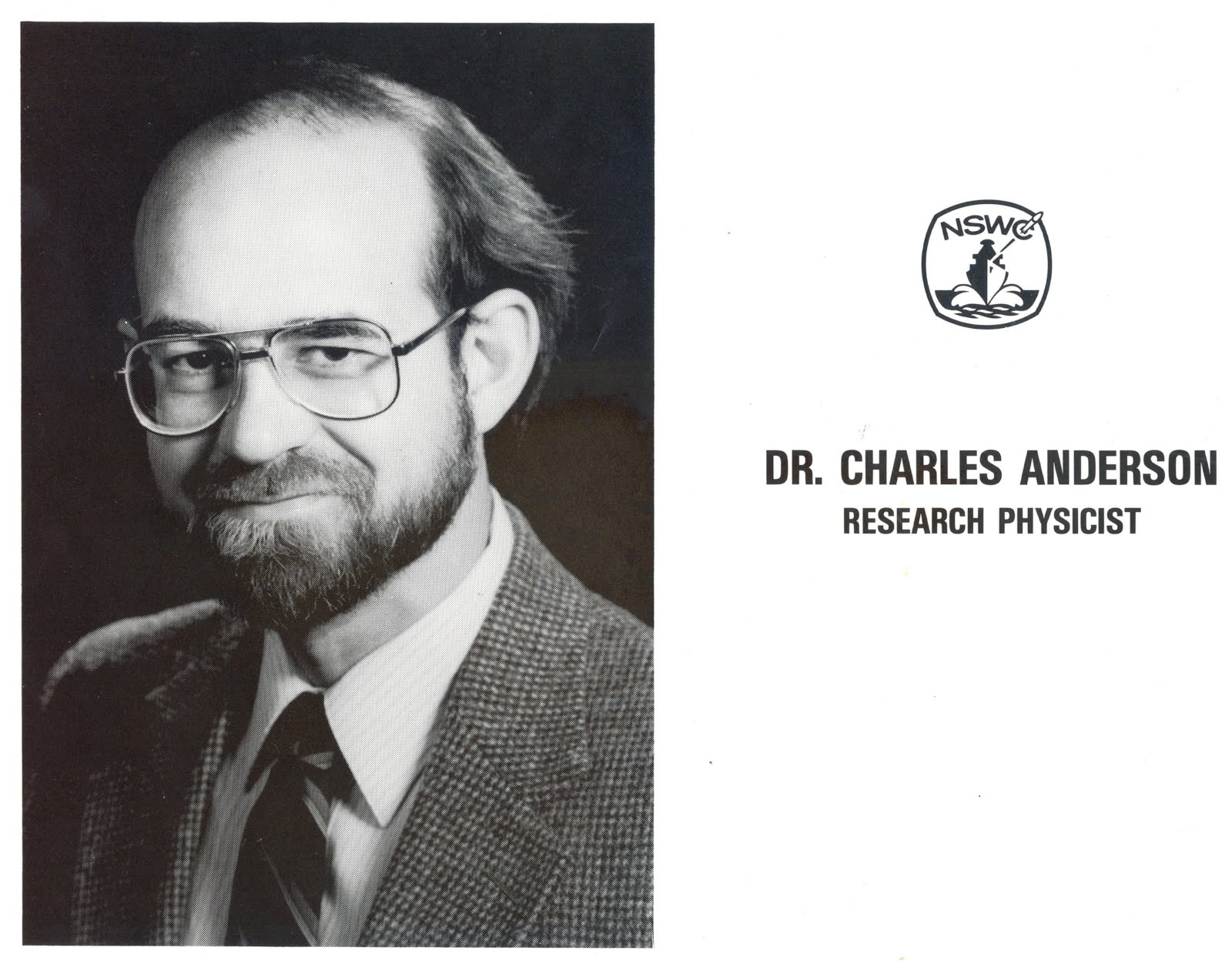

Charles,

Agreed. The Madoff case was particularly egregious. For YEARS, Harry Markopolos handed detailed proof of the Madoff Ponzi Scheme to the SEC on a silver platter. And, for YEARS, the SEC did precisely NOTHING!

http://money.cnn.com/2009/02/04/news/newsmakers/madoff_whistleblower/

Post a Comment